|

|

|

|

ECONOMIC

RESPONSIBILITY |

|

|

| |

| The commodities that we produce and the energy that we generate constitute the building blocks of the modern world. However, the value we create is not limited to these outputs but extends across society in a meaningful and effective manner. |

| We understand that as a global company we have a broader role in society than merely bringing resources to market. This is particularly true when considered in the context of operating in the developing world. With operations predominantly in India and Africa, we believe that our Group can and should add and share value in order to facilitate the development of the economies and communities where we operate. |

| We pursue a three-pronged approach to value. We add value to countries' exchequer by discovering natural resources and processing them so that they are fit for use. We enhance the value of our assets through technically and technologically advanced processes that help us tap more resources per pound. And we expend value by driving direct and indirect positive economic impact in the form of payment of taxes & royalties, and investments towards our employees and community. |

|

|

|

| I am confident that our talented team of professionals, who are committed to a sustainable future, will ensure that Vedanta continues to create significant value for all shareholders and benefit communities wherever we operate. |

Anil Agarwal | Chairman

Vedanta Resources plc |

|

|

| We believe in generating, sharing and cascading value - both financial as well as non-financial in the form of employment, community development, etc. |

| |

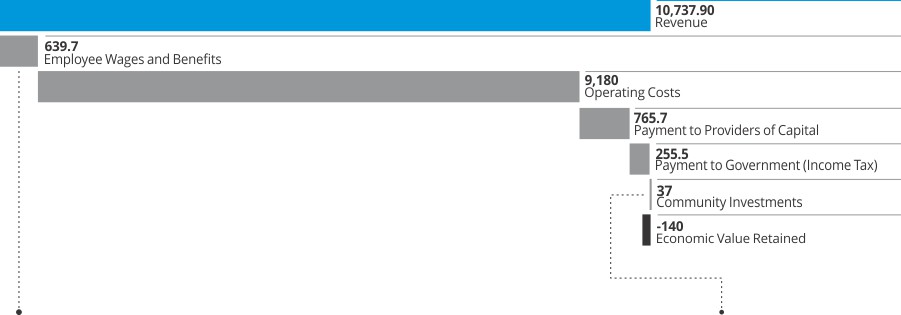

| ECONOMIC VALUE GENERATED & DISTRIBUTED (ECG&D) |

|

| FY 2015-16 Direct Economic Contribution |

in US$ mn |

|

|

|

|

| In the weak commodity price environment, we remain committed to optimising our operations, leveraging our high quality asset base and proactively managing our balance sheet. I am encouraged to see the positive results of our cost reduction programme gaining momentum and believe that this relentless focus on efficiency will not only make our business more resilient through the cycle, but position us favourably for any future improvement in market conditions. |

| Tom Albanese | CEO - Vedanta Resources plc |

| |

| OUR PRIORITIES |

| It is our endeavour to add value to each category of stakeholder we engage with. Here is a snapshot of our economic performance across the stakeholder spectrum. |

SHAREHOLDERS & LENDERS

|

| Commodity prices continued to fall in FY 2015-16. Prices of major metals like Iron, Zinc and Copper, that are central to our businesses, fell by 7% to 15% on an average. The underlying reasons for this continuing trend more or less remain the same: oversupply, weaker growth prospects in emerging economies (especially China) and a resurging US$. |

| The Government of India's vision of higher domestic production to reduce India's dependence on imports and the 'Make in India' programme, are expected to accelerate demand in the Indian metal market, creating a positive environment for Vedanta in its domestic market in the near-term and globally in the medium-term. |

| Revenue & EBITDA |

| In FY 2015-16, our revenues stood at US$ 10.7 bn; a 17 % fall from US$ 12.9 bn reported in FY 2014-15. EBITDA was US$ 2.3 bn, vis-a-vis US$ 3.7 bn in the previous year. This was primarily due to lower commodity prices. |

|

|

| Segment Contribution to Revenue |

in US$ mn |

|

| |

FY 2012-13 |

FY 2013-14 |

FY 2014-15 |

FY 2015-16 |

| Aluminium |

1,838 |

1,785 |

2,082 |

1,694 |

| Zinc |

3,061 |

2,857 |

2,944 |

2,503 |

| Oil & Gas |

3,223 |

3,093 |

2,398 |

1,322 |

| Iron Ore |

443 |

267 |

327 |

350 |

| Copper |

5,734 |

4,676 |

4,778 |

4,170 |

| Power |

669 |

622 |

672 |

707 |

| Elim/Others |

(327) |

(355) |

(321) |

(8.4) |

| Total |

14,640 |

12,945 |

12,879 |

10,738 |

|

|

|

| |

| Dividend |

| Since our IPO in December 2003, we have maintained a progressive dividend policy. Over the years, our shareholders have seen a total shareholder return of over 200% and we have paid a progressive dividend that was increased in nine out of ten years and held constant for one year. Over the last ten years, Vedanta has returned US$ 1.6 bn to shareholders, an average return of 8% per annum. In FY 2015-16, the Board proposed a dividend of 30 US cents per equity share. |

| |

| On March 30, 2016, Hindustan Zinc Limited declared a special Golden Jubilee dividend of 1,200% i.e. INR 24 (US$ 0.37) on an equity share of INR 2 (US$ 0.03) each. This is the largest ever dividend paid by any company in the private sector in Indian history. |

|

|

| Return to Shareholders |

per share |

|

| FY 2012-13 |

FY 2013-14 |

FY 2014-15 |

FY 2015-16 |

| US$ 58 |

US$ 59 |

US$ 63 |

US Cent 30 |

|

|

|

| |

GOVERNMENT

|

| At Vedanta, we believe that the best way to sustain our long-term profitability is by contributing to and ensuring the prosperity of the countries we operate in. The nature of our business necessitates that we understand the aspirations of men and women who surround the areas we operate in. |

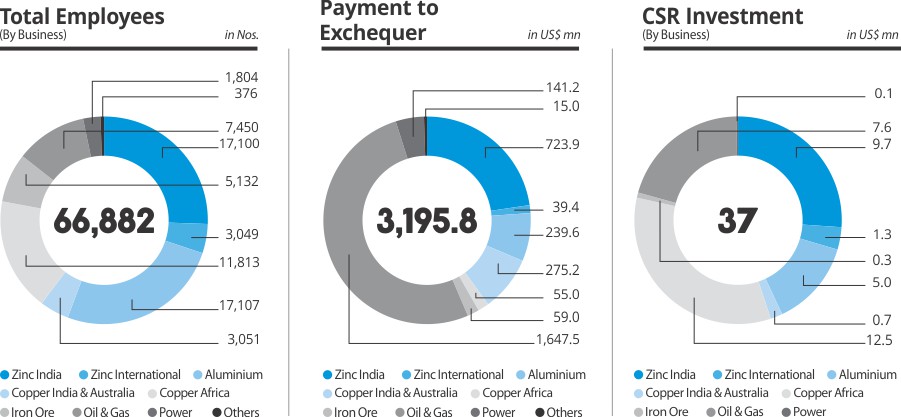

| We make a direct, positive economic contribution to national and state government budgets through the taxes and royalties we pay. Indirectly, we contribute towards developing industry sectors by participating in industry organisations and international bodies, protecting the environment by working closely with host governments, and by providing direct and indirect employment opportunities to 67,000 people across geographies. |

| |

| We have not received any direct financial assistance from governments, although as part of various direct tax holidays and similar exemptions, Vedanta did benefit by US$ 311 mn during FY 2015–16. |

|

Finanacial Assistance received

from Government |

FY 2015-16

311 |

FY 2014-15

239 |

|

|

|

| In FY 2015-16, the Vedanta Group cumulatively contributed US$ 3.2 bn to host governments by way of taxes and royalties. This excludes significant withholding taxes and social security contributions. |

|

|

| |

| In accordance with the UK Bribery Act, it is a Vedanta Board policy that neither the Group nor its subsidiaries will make donations or contributions to political parties within the United Kingdom or European Union. In India, political donations or contributions made within the context of legitimate business operations are made only with the approval of the Board. Last year, no political donation was made by any of our businesses. |

| |

| Tax Transparency |

| In recent years, Tax Transparency has gained a lot of importance in public eye. A range of initiatives have been launched worldwide addressing stakeholder requirements for transparent disclosure of revenues and tax arrangements. |

| Transparency is the core principle, as we firmly believe it is a pre-requisite to build trust which is the foundation for long-term sustainable value creation. We practice a tax strategy which conforms to our Code of Business Conduct & Ethics with zero tolerance on corruption and bribery. Our tax teams around the world are required to operate in accordance with clearly defined principles, including integrity and open communication. Management of tax affairs and tax risks is led by tax professionals who work in accordance with our established governance framework. |

| We remain at the forefront of tax reporting by managing the tax affairs in a succinct and straightforward manner. Therefore, in FY 2014-15, to ensure proactive transparency in tax reporting and greater accountability towards our stakeholders, we voluntarily produced our first Tax Transparency Report even before it became a mandate. The detailed report shows the contributions we made to the public finances in the countries we operate in. |

|

| |

|

| Paying fair share of taxes in the countries where companies operate is increasingly being seen as a 'social licence' to operate by various stakeholders. At Vedanta, we've been ahead of the curve by putting out a Tax Transparency Report in advance of any statutory requirements. We will now take this reporting to the next level by complying with the UK Report on payments to Governments Regulation 2014. |

| Pallavi Bakhru | Sr. Vice President and Group Head -Taxation |

| |

EMPLOYEES

|

| Our employees are our biggest assets. It is their passion, determination and professionalism that sets us apart. It is both our privilege and prerogative to invest in developing and retaining key talent. The remuneration and other benefits extended to our employees not only meets the laws of the land but also competes with the best in the industry. Being an organisation that upholds merit in hiring as well as career progression, we provide ample scope and a conducive work environment that nurture talent as well as motivate them towards long-term retention. |

|

|

|

|

|

For more information about our employee-centric initiatives,

please refer to the Employees Section on page 56. |

|

| |

| INITIATIVES |

| SHAPING FUTURE LEADERS AT ZAMBIA |

|

|

| As an endeavour to plug skill gaps in Zambia, Konkola Copper Mines (KCM) has spearheaded a two-pronged initiative. |

- A scholarship programme that awards selected

trainees, scholarships to study at universities in

India and Namibia before being employed by

the Company

- A structured in-house management training

programme, where trainees inculcate good work

culture, get acquainted to attributes of sound

management skills & work efficiency, and gain

exposure to global best practices

|

|

|

|

|

| In 2015, the Company recruited over 35 university graduates in mining engineering, human resources, business and metallurgy, as management trainees. Over 240 management trainees have been recruited, since the programme commenced in 2006. |

|

|

| |

SOCIETY

|

| Any long-term relationship is based on trust that stems from the responsibility, ownership and sincerity one demonstrates in one's actions. We believe that the communities in and around our areas of operations should benefit from our presence in their vicinity. This benefit should be multi-dimensional - the employment we generate; the infrastructure we support; and the wide-ranging social interventions we spearhead. |

| The remoteness of our operating locations gives us the opportunity to forge close ties with the local communities residing there. We work to enhance the infrastructure of the nearby villages through Private-Public Partnerships. These projects are identified by the community, brought to our notice by the local panchayats and village development committees and owned by the community collectively. |

| Our community investment focusses on health, education, livelihoods and environment. In FY 2015-16, we invested US$ 37 mn, benefitting more than 2.25 mn people globally through building hospitals, schools and infrastructure, developing employability skills and supporting community programmes. Rural livelihood was our priority during the year. |

|

|

|

|

| |

| Augmenting and upgrading community assets/common property resources such as constructing community centres, water tanks, roads, repair of schools building and others in partnership with the community and the local administration has also been one of our core activities. In the FY 2015-16, resource sharing between local authorities has resulted in the construction of 63 tube wells & bore wells, 20 km road development, 11 community centres, 283 check dams, and other structures and renovation works. |

| We target to build 50,000 toilets for households and schools in Rajasthan in the next 3 years. So far, Cairn and HZL have collectively freed 8,800+ families from open defecation in the state. In addition, we have ensured 24*7 access to potable water for the residents of Barmer and Sanchore, Rajasthan by installing ATW (Any Time Water) machines with RO plants. More than 35,000 families in Rajasthan benefit annually through our water programmes. |

| In Tamil Nadu, Sterlite Copper has partnered with the District Administration to work towards the 'Individual Household Toilet Project' to promote total sanitation in schools and panchayats. |

| We have observed four dimensions of indirect economic development in the local area, state and country at large: |

| Development of Local Skills | We aim to enhance the capacity of the local people through skill development programmes; thereby developing local support services and alternative income streams. |

| Development of Local Markets | Skill development augments purchasing power, increases the cash flow movement in the market and eventually, develops the market on the whole. |

| Development of Aspirations | With right skills and education, people aspire to grow and lead a happy life. |

| Development of Livelihood Opportunities | We have undertaken livelihood projects both in farm as well as non-farm sectors to provide sustainable livelihood opportunities to the local community. |

|

|

|

| |

|

For more information about how we are making a positive impact in the society, please refer to the Communities section on page 64. |

|

|

|

| |

INDUSTRY, SUPPLY CHAIN & CUSTOMERS

|

| We operate in some of the most remote geographies on the planet. In order to ensure smooth operations, we rely on a robust supply chain comprising downstream industries and support services. |

| Sourcing locally not only benefits local economies and governments, but also contributes to reducing the carbon footprint. In addition, due to the scale of our operations, we generate opportunities for the downstream industries and support services such as transportation. We work with local suppliers wherever possible, contributing to local market development. Importantly, this relationship extends to non-financial benefits such as skills development and training in areas such as health and safety, as well as making improvements to local infrastructure. |

| We have an established Supplier Code of Conduct, Supplier and Contractor Management Policies, Supplier Screening Checklist that encourage business partners and suppliers to adopt principles and practices comparable to our own. The Supplier Screening Checklist, which is used by our operations to screen and evaluate contractor compliance includes key aspects on legal compliance, HSE management, labour management, human rights and child labour. This checklist is used by operations to screen suppliers and contractors as part of a prequalification process prior to awarding work. |

| Our Value chain is described below - |

| |

| VALUE CHAIN |

| Exploration |

| We focus on extending the life of our mines and oilfields through focussed exploration, aimed at increasing our R&R base over and above what we extract each year. We prefer to explore brownfield opportunities across our current asset base, and a few select, large-scale, low-cost greenfield sites. |

| Asset development |

| We develop our resource base to optimise both production and the life of the resource. We also develop processing facilities that are strategically located close to our resources to optimise our costs and access to markets. |

| Extraction |

| Our operations are focused on mining metals and bulks, extracting oil & gas and generating power. We operate mines in India, Africa, Australia and Ireland, extracting zinc, lead, silver, iron ore, bauxite and copper. We produce oil &

gas from three operating blocks in India. |

| Processing |

| In line with our integrated value chain, we produce refined metals by processing and smelting the ore that we extract. We have smelters and other processing facilities in India

and Africa. We generate our own power for most of our operations, selling any surplus. We also sell power generated by our independent power plants and wind farms. |

| Value addition |

| While we are primarily upstream, we selectively add value by converting some of our primary metal products into higher margin products such as sheets, rods, bars and rolled products at our zinc, aluminium and copper businesses, depending on the profitability of adding value and the customer demand for these products. |

|

|

|

|

| |

| HIGH VALUE OUTPUTS |

| Natural resources |

| Our diversified portfolio produces high quality metals and minerals, LME- branded refined metals, and oil & gas, delivering industry leading EBITDA margins of over 40%. Our business activities are underpinned by a well-established Sustainable Development Framework to minimise our environmental footprint. |

| People and skills |

| We invest in developing our workforce, delivering over 1.24 mn hours of training, including over 756,000 hours of health & safety training. We attract and retain talented employees through management training and development programmes, supported by specific initiatives to encourage gender diversity. |

| Governments |

| We are a substantial contributor to the economies where we operate, both as an employer and a tax payer. We paid a total of US$ 3.2 bn in taxes and levies across the Group. |

| Society |

| We make an economic and social contribution to the communities where we operate. We invest US$ 37 mn in building hospitals, schools and infrastructure and providing community programmes for around 2.25 mn people. |

| Customers |

| We deliver high quality raw materials for our customers in line with international standards for quality settlement terms and delivery dates. We operate more than 25% of India's oil production and contribute to the nation's energy security. India has a deficit market and we are a large generator of power in India. |

| Shareholders |

| We have a progressive dividend policy and have returned US$ 1.6 bn in dividends to shareholders since the IPO in 2004 |

|

|

|

| |

| Our SAP supplier portal is an easy-to-use, highly efficient and secure method of communication between purchasing organisations and vendors. Requests for quotations, vendor bidding and auctions are carried out online to ensure transparency, with easy access to the status of offers, material dispatches and payments, ensuring transparency within the business and value addition to our suppliers. |

| Customers |

| We understand that meeting our customers' expectations is crucial to the growth of our business, particularly when we have such a significant presence in the market. We therefore ensure that our raw materials meet the required London Metal Exchange (LME) standards for entering the commodity market. We have defined systems and practices in place to understand and meet customer expectations and regularly engage with them through our marketing and customer relationship personnel. |

| All our activities are focused on ensuring customer needs are met in an appropriate and timely manner, including assisting our customers with technical issues and product development for first use. Customer satisfaction surveys are conducted periodically by external third parties. |

| No cases of non-compliance with relevant regulations, anticompetitive behaviour, anti-trust, monopoly and voluntary codes concerning the health and safety impacts of our products and services were observed or reported. Similarly, no significant fines for non-compliance with laws and regulations concerning the provision and use of products and services were reported. |

| |

| INITIATIVES |

IN SYNC WITH THE

EVOLVING CUSTOMER NEEDS |

|

|

| Hindustan Zinc Ltd. is today one of the most reliable and preferred suppliers of Zinc, Lead and Silver not just in India but globally. In part, this is because of the marketing efforts undertaken by the HZL team. |

| Over the years, the team kept its focus on consistency in quality, incorporation of modern best practices and understanding the pulse of the market. |

|

|

- As the market preferences matured from loose Zinc & Lead bundles without strapping, we set up

automated packaging facilities for slabs

- There has been a conscious change from a basic sales and distribution model to greater customer

orientation, with periodic customer satisfaction surveys, market surveys and focus on prompt deliveries,

faster account settlements and extensive technical customer service

- Keeping in mind the needs of the market, a number of innovative new products like Jumbo & CGG

(Continuous Galvanising Grade) have been introduced

|

| The Commercial function has also played a pivotal role in making HZL a world-class asset. There has been a paradigm shift in the procurement policy from the lowest cost price procurement (L1) to first, lowest Total Cost of Ownership (TCO) and then on to Full Impact Value (FIV) in accordance with international best practices. |

|

|

| |

|

| |

| For more information visit our group companies |

| |

|

|